Goods Transport Agency under GST

..

Transportation is a huge part of the economy. Any problems in transportation disrupts the entire business channel. This is why any petrol price change has a far-reaching effect in disruption of business.

.

The most popular form of goods transport in India is via road. As per the National Highways Authority of India, about 65% of freight and 80% passenger traffic is carried by the roads.

Transportation of goods by road are done by transporter or courier agency. This article will discuss the transporter,i.e., the GTA or goods transport agencies and the provisions of GST applicable on them.

.

What is a GTA?

As per Notification No. 11/2017-Central Tax (Rate) dated 28th June, 2017, “goods transport agency” or GTA means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called..

This means, while others might also hire out vehicles for goods transportation, only those issuing a consignment note are considered as a GTA. As per Explanation to Rule 4B, Service Tax Rules, 1994, a consignment note is a document, issued by a goods transport agency against the receipt of goods for the purpose of transport of goods by road in a goods carriage. The consignment note is serially numbered, and contains the names of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of the goods, place of origin and destination, and person liable for paying service tax whether consignor, consignee or the GTA .

.

The courts held only persons issuing consignment notes are covered within GTA. So, individual truck owners who do not book cargo and issue consignment note in normal course of business are, not GTA and accordingly, services provided by them are not liable to service tax.

.

Service Tax

RCM applied under Service tax. There was an abatement of 60% for transportation of used household goods and 70% for transportation of normal goods..

Goods Transport Agency under GST

GST will not apply on transport of following goods by a goods transport agency-- agricultural produce

- milk, salt and food grain including flour, pulses and rice

- organic manure

- newspaper or magazines registered with the Registrar of Newspapers

- relief materials meant for victims of natural or man-made disasters

- defence or military equipment

- goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage is less than Rs. 1,500

- goods, where consideration charged for transportation of all such goods for a single consignee does not exceed Rs. 750.

Rates

.

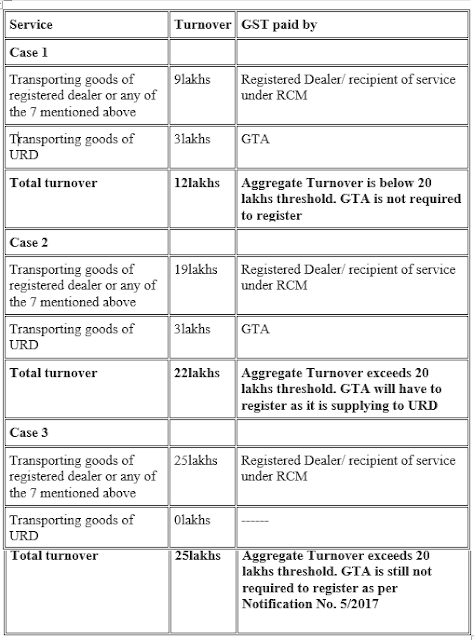

Is a GTA liable to register?

As per Notification No. 5/2017- Central Tax dated 19/06/2017, a person who is only engaged in making supplies of taxable goods/services, where the total tax on which is liable to be paid on reverse charge basis by the recipient as the category of persons exempted from obtaining registration under GST..

Thus, a GTA does not have to register under GST if he is exclusively transporting goods even if the turnover exceeds 20 lakhs as the total tax is required to be paid by the recipient under reverse charge basis.

.

Reverse Charge in case of GTA

Normally a service provider is required to pay taxes, but in case a GTA provides the services to the following persons, recipient of services is required to pay GST under reverse charge (notification No. 13/2017- Central Tax (Rate) dated 28th June, 2017) :-- Factory registered under the Factories Act,1948

- A society registered under the Societies Registration Act, 1860 or under any other law

- A co-operative society established under any law

- A person registered under GST

- A body corporate established by or under any law; or

- A partnership firm whether registered or not (including AOP)

- Casual taxable person

Who will pay under Reverse Charge Basis?

As per Notification No. 13/2017- Central Tax dated 28/06/2017 the person who pays or is liable to pay freight for the transportation of goods by road in goods carriage, located in the taxable territory shall be treated as the receiver of service..

Payment is by sender

If the supplier of goods (consignor) pays the GTA, then the sender will be treated as the recipient. If he belongs to the category of persons above then he will pay GST on reverse charge basis.

.

Payment by Receiver

If the liability of freight payment lies with the receiver (Consignee), then the receiver of goods will be treated as a receiver of transportation services. If he belongs to any of the above category of persons, then he will pay GST on reverse charge basis.

.

Situations showing who is liable to pay GST in case of a GTA-

..

Note:

As per notification Notification No.8/2017-Central Tax (Rate) dated 28thJune 2017, intra-State supplies of goods or services or both received by a registered person from any supplier, who is not registered, is exempted from GST if it does not exceed Rs. 5,000 in a day.

If the transport charges are less than Rs. 5,000 per day then no GST will be payable.

.

.

Input Tax Credit

.

**** GTA can opt for 12% GST with ITC or 5% GST with no ITC. However, the GTA has to give an option at the beginning of financial year.

.

Note: Notification No. 11/2017 Central tax (Rate) dated 28.06.2017 & GST Council 20th Meeting on 5th Aug

.

The notification mentions that the restriction of ITC is only on goods or services used in supplying the GTA service.,i.e., they are referring the GTA itself.

In case of reverse charge, the person paying tax is the service recipient who is not supplying the GTA service so the concern of using any inputs to supply GTA service does not arise. He is liable to pay GST only because of RCM.

.

So GST paid on GTA under RCM can be availed as ITC by the person paying the tax. As per GST Council’s 20th meeting, GTA has the option to claim full ITC by paying 12% GST or pay 5% without ITC..

.

Place of Supply

The place of supply of services by way of transportation of goods, including by mail or courier to––(a) a registered person, shall be the location of such person

(b) a person other than a registered person, shall be the location at which such goods are handed over for their transportation.

.

.

Examples:

Rajesh is a registered dealer in Bangalore. He hires a GTA to deliver goods to Mumbai.

Place of supply will be Bangalore.

Anita is unregistered dealer in Gujarat who hires a GTA to deliver goods to Rajasthan.

Place of supply will be Gujarat where Anita hands over the goods to the transporter.

Vikas is registered in both Mumbai and Bangalore. He hires a transporter (based in Mumbai) to deliver from Bangalore to Delhi.

CGST & SGST will be applicable.

If the transporter is based in Chennai, then IGST will be applicable.

.

Invoicing for GTA

Any GST compliant invoice of a GTA must have following details-- Name of the consignor and the consignee

- Registration number of goods carriage in which the goods are transported

- Details of goods transported

- Gross weight of the consignment

- Details of place of origin and destination

- GSTIN of the person liable for paying tax whether as consigner, consignee or goods transport agency

- Name, address and GSTIN (if applicable) of the GTA

- Tax invoice number (it must be generated consecutively and each tax invoice will have a unique number for that financial year)

- Date of issue

- Description of service

- Taxable value of supply

- Applicable rate of GST (Rates of CGST, SGST, IGST, UTGST and cess clearly mentioned)

- Amount of tax (With breakup of amounts of CGST, SGST, IGST, UTGST and cess)

- Whether GST is payable on reverse charge basis

- Signature of the supplier

Payment of Tax by a GTA

A GTA cannot enjoy any ITC on any of the inputs. So, payment of tax will be only through cash in the normal modes of card/netbanking/cash (only for taxes upto Rs.10,000).

Returns to be Filed by a GTA

If all the services of the GTA fall under RCM then a GTA is not required to register.

If a GTA registers, then it will have to file the normal 3 monthly returns – GSTR-1 (sales), GSTR-2 (purchases-no ITC available) & GSTR-3 (monthly summary & tax liability).

.

.

FAQs on GTA

Ajay hired a GTA to transport his goods. The consideration charged was Rs. 1,200. Will Ajay pay GST?Ajay will not pay GST under RCM as the consideration for transportation of goods on a consignment transported in a single carriage is less than Rs. 1,500.

.

Vinod hired a GTA to transport goods. The GTA was asked to come 2 days as Vinod would receive the goods in batches. The entire consideration was Rs. 600. Will Vinod pay GST?

Vinod will not pay GST because the consideration charged for transportation of all such goods for a single consignee does not exceed Rs. 750.

.

Mr. Ajay, a working professional, is moving houses and hires XYZ GTA to transport his household items. XYZ demands Ajay to pay GST under RCM as moving charges are Rs. 6,000. Ajay is confused.

Ans: Ajay is unregistered and if XYZ GTA is also unregistered under GST then, GST is not applicable.

If XYZ is registered, then it will pay GST of 5%. RCM will not apply on Ajay.

.

Anand, a garments shop owner in Kolkata, hires a truck to deliver goods from wholesaler to his (Anand’s) shop. Anand’s turnover is less than 20 lakhs and he has not registered under GST. The GTA demands that Anand should pay tax under RCM. Anand argues that since he is not registered, he does not have to pay any GST.

Ans: Only the persons above (Notification No. 13/2017- Central Tax (Rate) dated 28th June, 2017) are required to pay GST under RCM. Unregistered dealers (Anand) purchasing goods/services from unregistered GTA do not have to pay GST under reverse charge mechanism. If the URD hires from a registered GTA, then the registered GTA is liable to pay GST.

So, Anand is not liable to pay GST under RCM.

.

Anand now purchases garments from Assam and pays for a truck to deliver the goods to his shop in Kolkata. The GTA says that Anand has to register for GST as he is making an inter-state purchase as only registered dealers can have inter-state trade.

Ans: An unregistered person can make inter-state purchases. For making inter-state sales, he will have to be compulsorily registered.

Since Anand is an unregistered dealer and the GTA is also unregistered then the concept of RCM does not arise.

.

The GTA is registered at Assam and its branch is collecting cash in kolkata on his behalf. Recipient of service Anand is in kolkata. If Anand was registered, would he have charged IGST or SGST/CGST under RCM?

If the original transporter in Assam sends the bill to Anand, then IGST should be charged. If the branch sends the bill then SGST/CGST will apply.

.

Anand has received a one-time contract to sell garments to a dealer in Mumbai. Anand hires a truck to send the goods.

Since, Anand is not registered under GST, he cannot make any inter-state sale. To make an inter-state sale, he must register as a casual taxable person. Then when he hires a truck to send the garments, automatically he is liable to pay GST under RCM.

.

Anand decides to voluntarily register. He hires a truck again to transfer goods from the wholesaler to his shop. GTA asks him to pay GST on RCM as he is registered. But Anand’s view is that his turnover is still below 20 lakhs.

Ans: The threshold of turnover does not matter if a person is voluntarily registered. All provisions of GST Act will apply to a registered person. Anand is liable to pay GST under RCM.

.

Anand’s turnover has increased to 45 lakhs. He wants to shift to composition scheme as he sells mainly to end consumers. But he is worried as his GTA has told him they would not deliver his goods if he is registered under composition scheme as the GTA become liable for GST.

Ans: This is a myth. Even composition dealers are liable to pay GST under RCM. Anand will pay GST on RCM if he hires a GTA whether he is registered as a composition dealer or as a normal dealer.

.

Conclusion

The concept of RCM on GTA was also there under service tax. The idea is to bring the unorganized sector of delivery through trucks under tax. The transporters neither registered nor paid any taxes which is why government shifted the tax incidence to the receiver of transport service in order to collect tax.

However, RCM under GST has launched confusion due to the law “persons who are required to pay tax under reverse charge” have to be compulsorily registered. Transporters have already started to refuse unregistered dealers.

This article hopes to bring some clarity to the situation.

.

.

.

.

REGARDS

ACA SOURAV BAGARIA

Hey Very Nice Blog!! Thanks For Sharing!!

ReplyDeleteonline taxi booking in lko

luxury car booking in lucknow

luxury cars for rent in lucknow